Turkish Lira Forecast & Price Predictions for Today, 2023 and Beyond: Will the TRY drop further?

- Erdogan Sharip

- May 3, 2023

- 6 min read

The Turkish lira (TRY) has fallen to fresh lows against the US dollar (USD), with inflation running close to 60% and the government continuing to pursue strong exports and production with a weak currency and lower interest rates.

The Turkish Lira continued to decline during February, recording its lowest level against the dollar ever, approaching the barrier of 19 lira per dollar. The repercussions of the natural disaster that shook Turkey and northern Syria still cast a shadow over a lot of data, as the latest estimates revealed losses above $10 billion in national income and $3 billion due to work being stopped for days.

In this context, the Turkish government issued some decisions aimed at speeding up reconstruction, as it banned the export of container homes and prefabricated buildings for a period of 3 months. Meanwhile, the Istanbul Stock Exchange index went up by 10% after the resumption of trading after five days of the closure decided by the government, following strong declines recorded by the stock market in two sessions following the earthquake, these gains were recorded with the support of some government measures aimed at stopping stock losses. In the meantime, some analysts warned of a decline in confidence in the stock market and Turkish Lira.

High-interest rate currencies like the Turkish lira are very attractive to those who are aiming for swap points in forex trading. However, for beginners, trading for Turkish lira swap points carries a great deal of risk.

Follow the USD/TRY, EUR/TRY, and GBP/TRY price charts for live data and read our latest Turkish Lira forecast and price predictions for 2023 and beyond. Key pivot points and support and resistance levels provide further insights to help you make informed trading decisions.

Turkish Lira Forecast & Price Prediction – Summary

Turkish Lira price prediction today: According to charts and experts, any decline in the pair represents an opportunity to buy back again. .

Turkish Lira price prediction 2023: While forecast agencies estimate USD/TRY to trade around 23 at the end of 2023, the most bearish banks forecast the pair to trade at 25 in 12 months.

Turkish Lira forecast for the next 5 years and beyond: Agencies and banks continue to forecast a Turkish Lira decline in the next years and USD/TRY to reach 30 by 2025.

With CAPEX.com you can trade CFDs on USD/TRY, EUR/TRY and GBP/TRY with low spreads and 1:10 leverage.

Turkish lira Overview

The Turkish lira (TRY) appears to have stabilized since early October 2022, thanks to nearly 100 new regulations adopted by the country’s central bank ahead of Turkey’s elections in 2023.

The lira has lost around 40% against the US dollar (USD/TRY) in 2022, after plunging by 46% in 2021, driven by President Tayyip Erdogan’s unconventional views on addressing inflation by cutting interest rates rather than lifting them.

Turkey's central bank held interest rates at 9% for a second straight month on Thursday, and analysts said it could return to easing in the run-up to May elections given inflation is expected to drift lower from 64% last month.

The central bank (CBRT) said the inflation level and trend have improved due to a broad state strategy of boosting lira use. Relatively stronger domestic demand offset the recent economic slowdown due to weaker foreign demand, it added.

President Tayyip Erdogan faces tight elections in four months in which the cost-of-living crisis is a top concern. He could soon urge more rate cuts as part of his unorthodox stance that policy easing also lowers prices, analysts said.

A previous easing cycle in 2021 sparked a currency crash that stoked the wave of inflation that peaked at a 24-year high above 85% in October. It came down to 64.3% in December, largely due to a favorable base effect.

In its most recent move, the Central Bank of Turkey (CBT) cut its interest rate by 150 basis points (bps) to 9% in its November 2022 meeting, in line with market expectations.

The bank stressed that it had decided to end the cycle of rate cuts that started in August as its current level is "adequate”, signaling that it would end the rate-cutting cycle.

The decision added to the 1000bps in unorthodox rate cuts since September of 2021 despite a plunging lira, soaring consumer prices, and an unbalanced current account.

Inflation crossed 80% during 2022, according to data from the Turkish Statistical Institute – the highest level since 1998 – primarily due to surging costs of importing energy with an increasingly weak currency.

Is there a trading opportunity for foreign exchange (forex) investors in going long or short on the lira following the currency’s nosedive against the dollar, euro, and pound?

The next sections look at the lira’s recent performance, analysts’ expectations, and Turkish lira forecasts.

Turkish lira technical analysis: how low can it go?

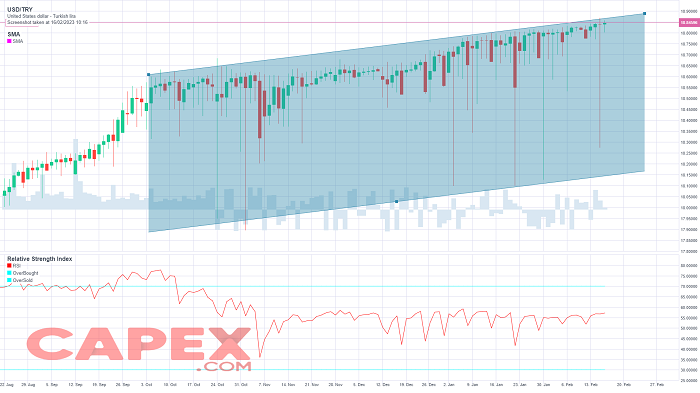

On the technical front, the Turkish Lira traded lower, setting new records of decline against the dollar and euro at the beginning of 2023. The pairs continued to trade within the levels of the ascending channels, albeit at a slow pace.

Any decline in the pair was seen as an opportunity to buy back again at the beginning of 2023. However, a break below key support levels in USD/TRY, EUR/TRY and GBP/TRY will signal a potential change in market sentiment and trend.

The USD/TRY is trading at the upper band of the ascending channel, above the previous resistance levels that have become support: 18.76, 18.70, and 18.63, respectively. At the same time, the pair is trading below the resistance levels at 18.88 and 18.94, which represents the highest price for the pair ever, and the pair is also trading below the psychological resistance levels at 19.00.

The dollar pair against the lira is also trading above the moving averages 50, 100, and 200 on the daily time frame, while the price is trading between these averages on the four-hour time frame, in a sign of the general bullish trend for the pair.

EUR/TRY (Euro Turkish Lira Technical Forecast)

The EUR/TRY currency pair moved above the 20 lira-per-euro mark at the start of the year, reaching an all-time high of 20.75. The decline below the key 20 levels was seen by traders as a new opportunity to go long, as indicated by the spike on the daily chart.

Turkish Lira forecast: Can TRY to stabilize or it will decline further?

According to Commerzbank, the government and central bank introduced rescue measures, such as incentives to convert foreign exchange (FX) deposits to lira deposits and compulsory conversion of export revenues in order to enhance dollar supply in the market, and the lira exchange rate has momentarily stabilized. The strategy is referred to as "lira-ization" of the economy.

These measures don't deal with the fundamental issues of uneven monetary policy and a dubious central bank per analysts. According to media reports, banks are already intervening in foreign exchange markets to support the lira. Commerzbank anticipates the next significant movement in USD-TRY following a brief respite.

According to ING, the CBT has recently taken certain actions to oversee banks' pricing choices and the makeup of loan portfolios, while also attempting to curb growth in a few specific commercial loan types. These actions are also intended to help the demand for government bonds. Given this context, authorities' goals have remained to maintain a favorable financial environment.

Gross reserves recently increased significantly as a result of swap transactions with banks, growth in the banking sector's FX deposits, and greater FX reserve requirements.

While a slowdown in lending should help the lira, the continued requirement for large levels of external funding, a less rosy prognosis for the world economy, and the preference of policymakers to keep interest rates low should continue to be important variables in deciding the currency outlook.

US Dollar - Turkish Lira Forecast

The TRY prediction from Danske Bank was the most bearish, with the bank’s analysts forecasting that the USD/TRY rate could reach the 25 levels in 12 months’ time.

“As long as an acute financial crisis can be avoided, the move is likely to be gradual,” the bank commented in a research note on 2 September 2022.

ING forecast that the 20 lira-per-dollar mark could be breached earlier, with the rate potentially hitting 21.20 during Q1 2023 – and reaching 23.30 by the third quarter of 2023.

ING’s USD/TRY forecast shows the pair reaching 24 by the end of 2023. The bank’s forecast for the end of 2024 shows the pair trading at 27.50, indicating a bullish USD/TRY forecast for 2025.

Trading Economics was also bearish in its Turkish lira projections as of February 2023, forecasting that the USD/TRY rate could move from 19.064 at the end of this quarter to 19.83 in a year’s time.

In its Turkish lira forecast for 2023, algorithm-based forecast website WalletInvestor saw the USD/TRY currency pair averaging 19.46 during Q1, with a high at 20.56. The website’s Turkish lira forecast for 2023 saw the currency decline further against the US dollar, ending the year at a potential average of 22.78.

Based on historical data, the platform issued a longer-term prediction than most banks – its Turkish lira forecast for 2025 predicted that USD/TRY would trade at an average of 30.727 by the end of that year.

The American dollar to Turkish lira forecast from SEB Group expected a somewhat slower rise towards the 23 levels, with 22.50 in a year’s time.

Comments